“Despite rising interest rates last year, timberland values reached record highs due to other market forces,” TIR Managing Director, Economic Research and Analysis, Chung-Hong Fu, explained at the June 26, 2024, CFA Society.

ATLANTA, GA — Entitled, “Will Recent Economic Headwinds Threaten U.S. Timberland Returns?,” Fu’s remarks focused on the current economic environment and market trends that are impacting the forest products sector. This led to the heart of the presentation, which was centered around timberland’s sensitivity to interest rates and the performance of timberland overall against economic downturns.

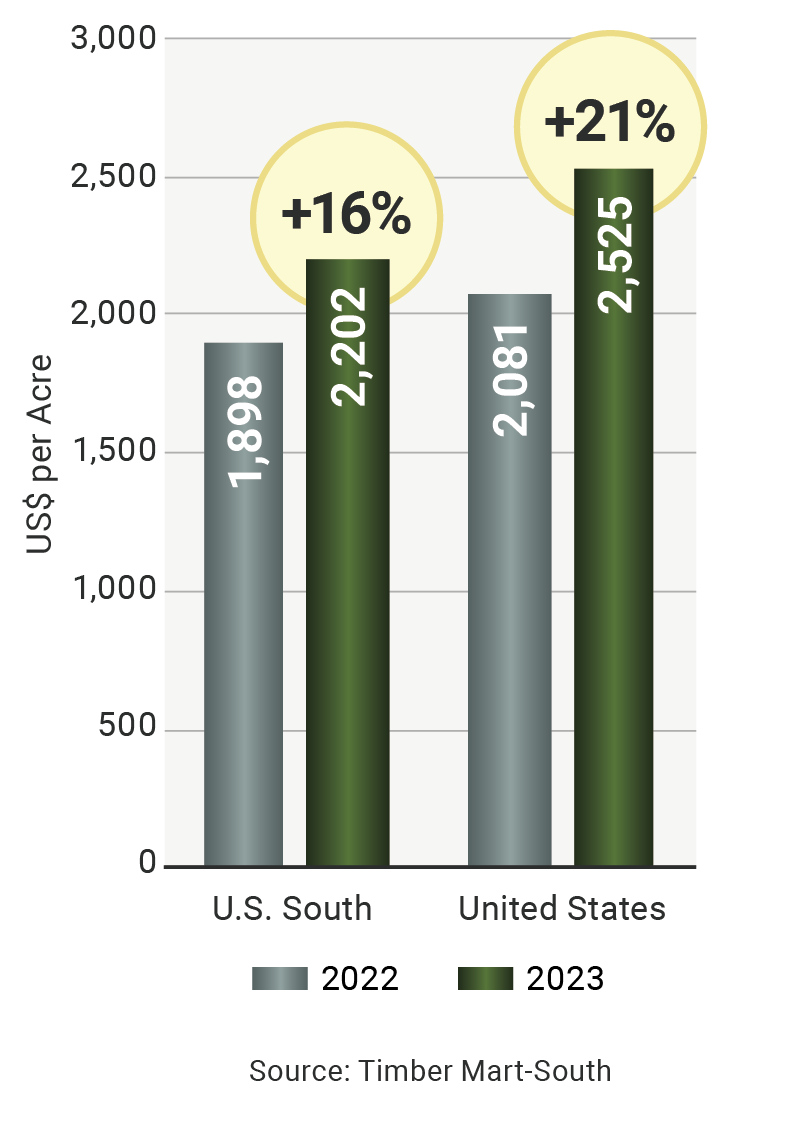

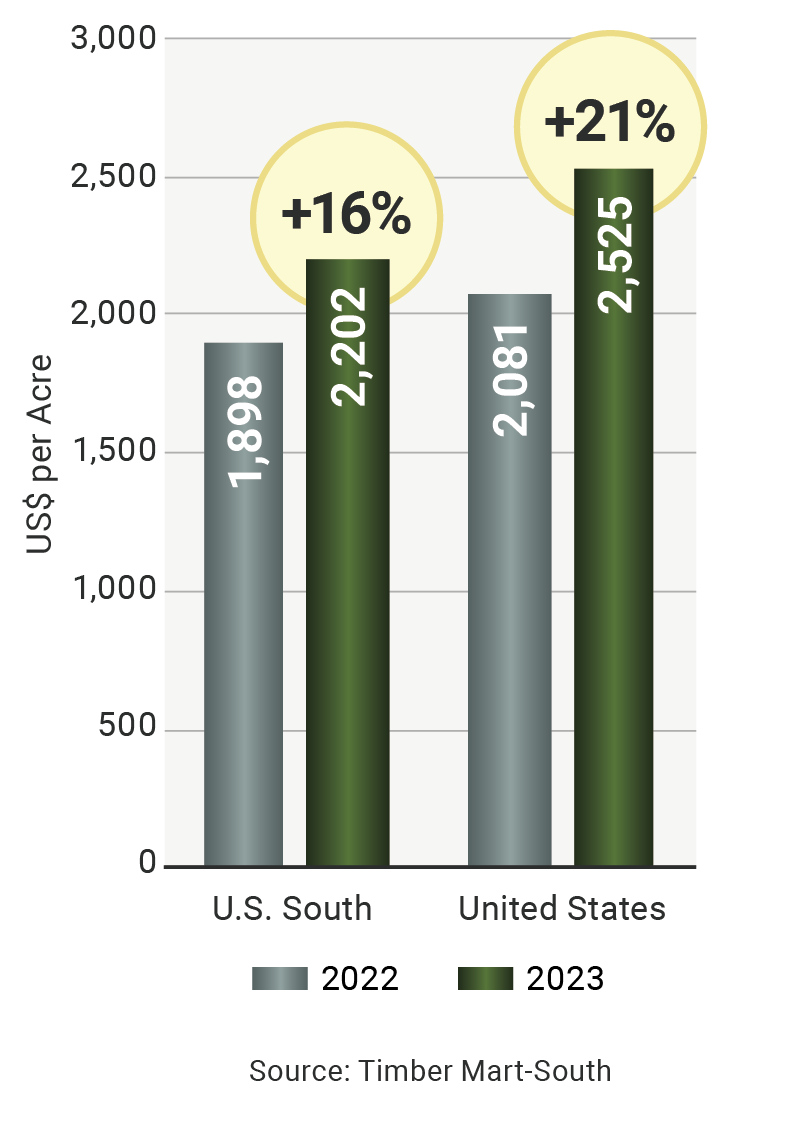

Fu pointed out that interest rates play an important role in the valuation of timberland and the end-use demand for wood products, such as housing. Amid weak demand, he indicated that timber prices have retreated since 2022 following the rise of long-term rates in 2021. Moreover, Fu explained that “higher interest rates typically lead to higher discount rates,” which generally cause valuations of assets like timberland to drop. Yet, the average per acre transaction price for timberland in the U.S. South was up 16% between 2022 and 2023 and up over 20% for all U.S. transactions.

Acres-Weighted Average Price of Timberland Sales

Acres-Weighted Average Price of Timberland Sales

Interest rates play an important role in the valuation of timberland and the end-use demand for wood products.

To explain this seemingly counterintuitive relationship, Fu enumerated four key factors that contribute to the resiliency of timberland’s asset value:

- Buyers are likely factoring in a strong recovery in timber prices in their pro forma valuations given pent up demand for housing in the U.S.

- There is a large influx of investor capital into timberland – including those seeking to tap carbon credit markets and other natural capital solutions

- Private individuals in the retail land market continue to seek timberland for long-term capital preservation, recreation, and legacy values

- Alternative uses such as solar farms, wetlands mitigation banking, and conservation easements have gained momentum

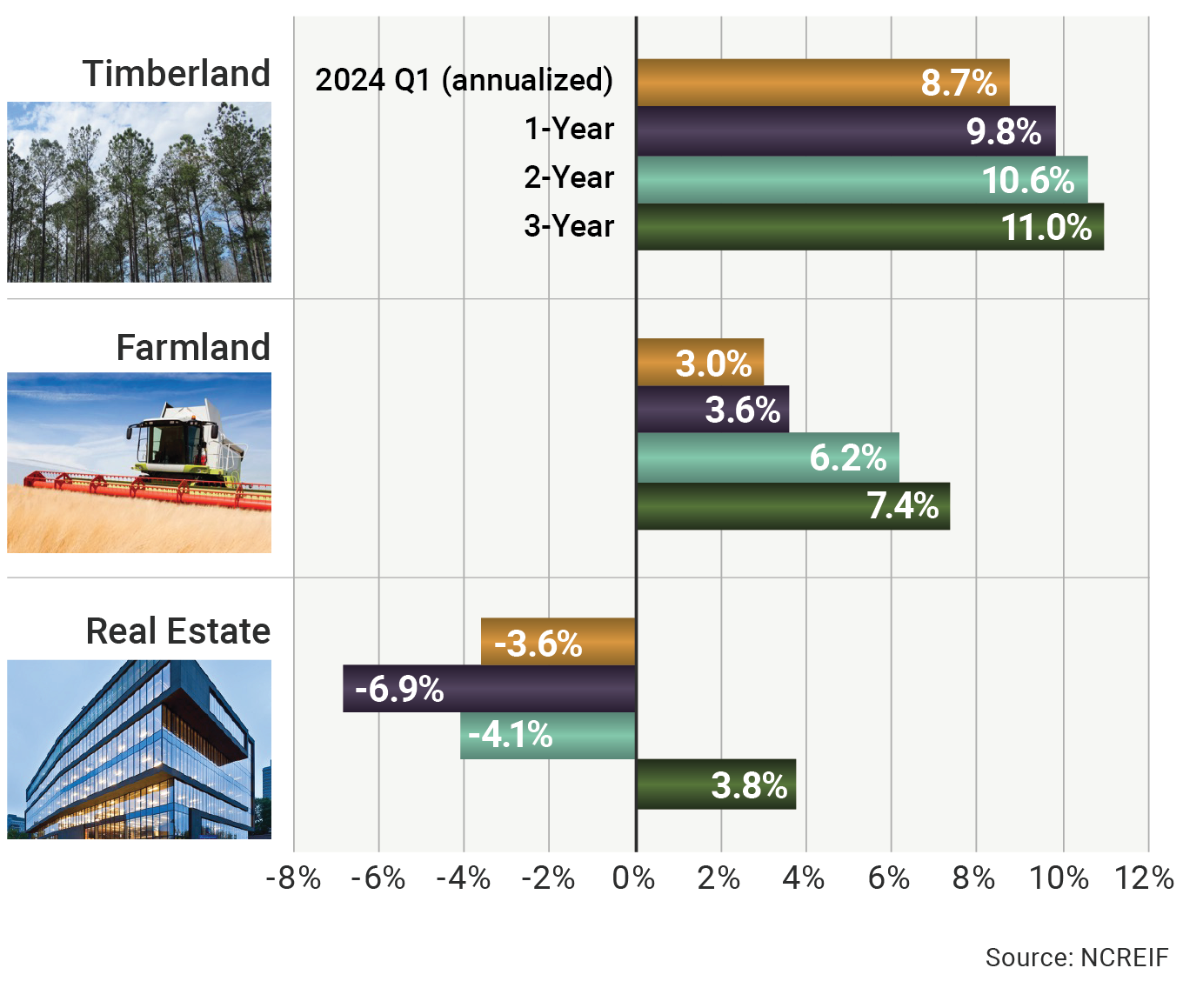

Along with the uplift created by higher land values outweighing the drag of soft timber markets, Fu suggested that these factors helped drive timberland to be among the better-performing real assets over the past three years and demonstrated that it can yield solid returns across varying economic cycles.

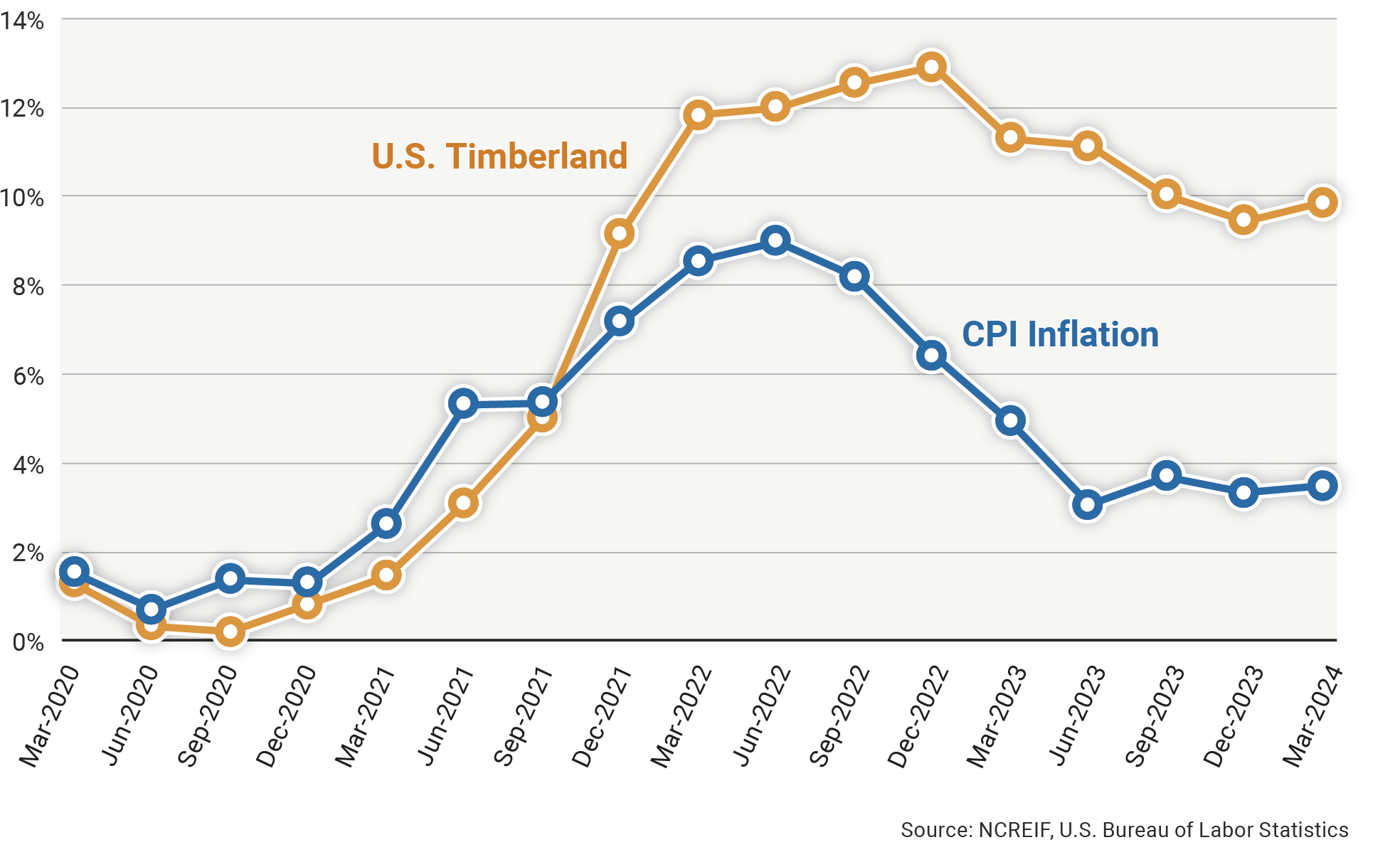

He concluded his presentation noting that timberland is not only a good long-term inflation hedge, but it also provides important portfolio diversification benefits for investors.

Total Return for U.S. Real Assets Ending 2024 Q1

U.S. Timberland Total Returns (Annualized) During U.S. Economic Recessions

Fu noted that timberland is not only a good long-term inflation hedge, but it also provides important portfolio diversification benefits for investors.

Rolling 4-Quarter Timberland Returns and U.S. CPI Inflation (2020 Q1 – 2024 Q1)

Chung-Hong Fu, Ph.D., is a TIR Managing Director and oversees all economic and market analysis as well as forecasting for the firm. A copy of this presentation is available here.