Experience

Our team has in-depth timberland investment management skills and experience in every aspect of the discipline. We believe this allows us to add value at each stage of the investment process – when we buy timberland, as we manage it and when we sell clients’ forests.

Market Leaders

Our senior leadership team consists of the firm’s partners, each of whom averages over 30 years of experience implementing advanced timber management and timberland investment strategies. We are experts at:

- Developing timber regeneration strategies

- Conducting timber inventory analysis

- Forecasting and projecting timber growth and yields

- Implementing stand-level timber management techniques

- Planning and scheduling timber harvests

- Initiating and negotiating timber sales and supervising harvest operations

- Practicing sound environmental stewardship

We call our approach, Alpha-Driven Forestry™, because we are entirely focused on producing both biological and financial alpha for our clients.

TIR currently manages more than 900,000 acres in the U.S. Southeast, Northeast, Midwest, and Pacific Northwest for a variety of institutional clients. We also have a London-based affiliate, Timberland Investment Resources-Europe, which primarily services a European clientele of institutional and high-net-worth investors.

Thought Leaders

TIR strives to be recognized in the marketplace as an innovative thought leader – a firm that takes a purposeful, academic and transparent approach to analyzing the timberland asset class and the factors and trends that influence it. Our research team includes individuals who have an average of almost 20 years of experience in all facets of forest economics and biometrics. They have written numerous articles for academic and industry journals on a range of related topics, including forest finance, forest industry trends and forest and timber management. The team also has extensive global forestry experience in the major commercial timber regions of South America, New Zealand, Australia and Central Europe. Our diverse research experience is applied to the development and management of clients’ portfolios at every stage of the investment process.

Transaction Experts

TIR takes a team approach to transactions management. During the last 30+years, our leadership team has acquired more than 2.6 million acres of timberland by executing more than 220 separate transactions. These acquisitions were made in every major timber investment region of the U.S., including the Southeast, Pacific Northwest, Northeast, and Lake States. In addition, since TIR’s inception, we have sold more than $1.4 billion of timberland assets for clients by completing more than 2,500 land sales. Although we were founded in the U.S. and have made it the focus of our operations, we also have extensive experience analyzing global acquisition opportunities and developing management strategies for non-U.S. markets. These skills are being put to increasing use as we expand our business around the world and introduce our clients to new and emerging opportunities.

Contributions of US Timberland Returns

Based on NCREIF Timberland Property Index, 1987-2025

Income

Appreciation

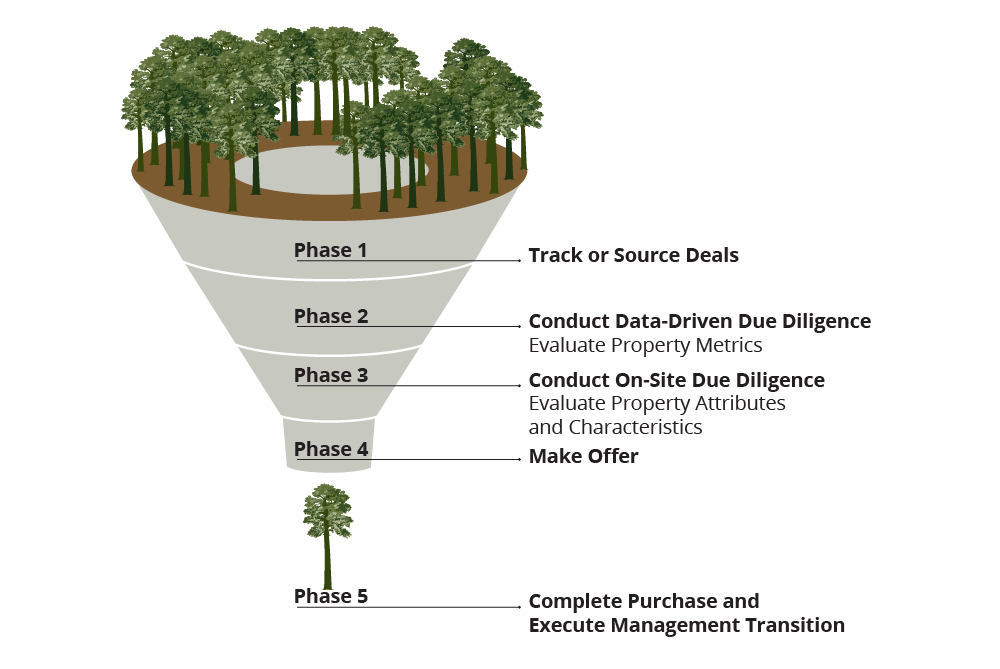

Timberland Acquisition Process

Integrated Managers

TIR utilizes a highly integrated business model. Our leadership team oversees investment strategy, including acquisitions, forest management and dispositions, for each portfolio and a senior executive of the firm is assigned to oversee the operation of each client’s investment program. His or her efforts are supported by our acquisitions, research and finance and accounting teams. Our client relations team, which is headed by Managing Director Tom Johnson, coordinates all interaction and communication with investors.

TIR’s field operations are overseen by regional managers and foresters, each of whom has had advanced training in a variety of associated disciplines, including forest finance and forest operations. We practice Alpha-Driven Forestry™, which means managing clients’ timberland assets with a focus on producing both biological and financial alpha. Our investment-trained foresters direct all reforestation, silviculture, environmental stewardship, harvesting, and timber and land merchandizing activities on behalf of our clients. They also participate in acquisition sourcing and due diligence as well as our land sales program. TIR outsources all non-core forestry activities, like tree-planting, road maintenance and boundary-line marking, to independent contractors. This is done to maintain our focus on higher-value management functions and to reduce operational costs for our clients.

Professionally Engaged

Our team is actively involved in a wide range of forestry and relevant professional associations. These include:

- CFA Institute

- Atlanta Society of Financial Analysts

- Society of American Foresters (SAF)

- Arkansas Forestry Association

- Georgia Forestry Association

- North Carolina Forestry Association

- Texas Forestry Association

- Virginia Forestry Association

- Georgia Society of CPA’s

- The Alumni Council at Duke University’s Nicholas School of the Environment

- Human Capital Institute

- CAIA Association

- University of Georgia’s Center for Forest Business Advisory Committee

- The National Association of Forest Owners (NAFO)

- The Forest Landowners Association