Investment Mechanics

Direct investment in timberland typically entails engaging investment experts with forestry expertise to build and manage portfolios of assets that are consistent with investors’ risk and return profiles.

Investments in timberland are usually made through individually managed separate accounts, which consist of one or more timberland properties, or pooled funds, which offer investors pro-rata interests in a collection of timberland assets.

A variety of investment structures and vehicles can be employed to invest in timberland. The most common of these at present are limited partnerships, limited liability corporations and private real estate investment trusts (REITs).

Estimated Value of Global Institutional Investments in Timberland Under Management (in US$ Billions)

Sources: Timberland Markets Report, Timberlink

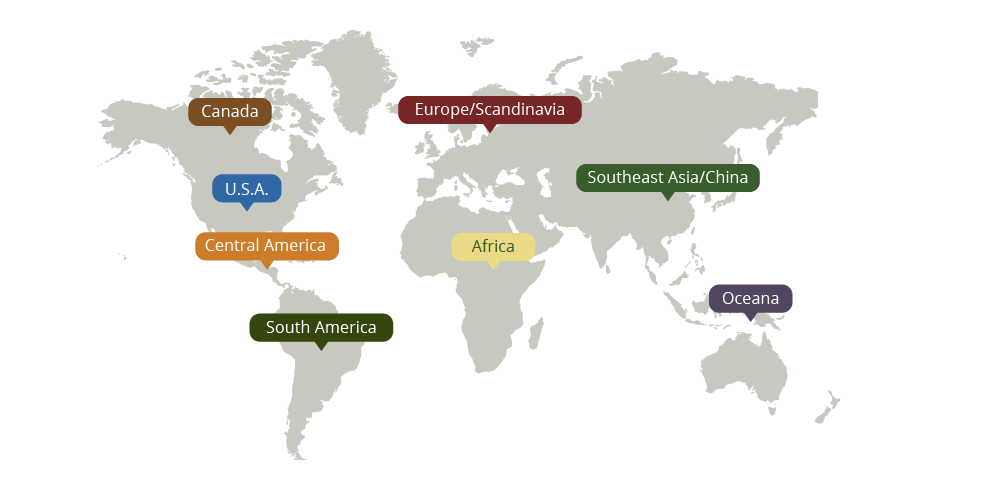

Categorizing and Quantifying Risk and Return in Global Timberland Investment Markets

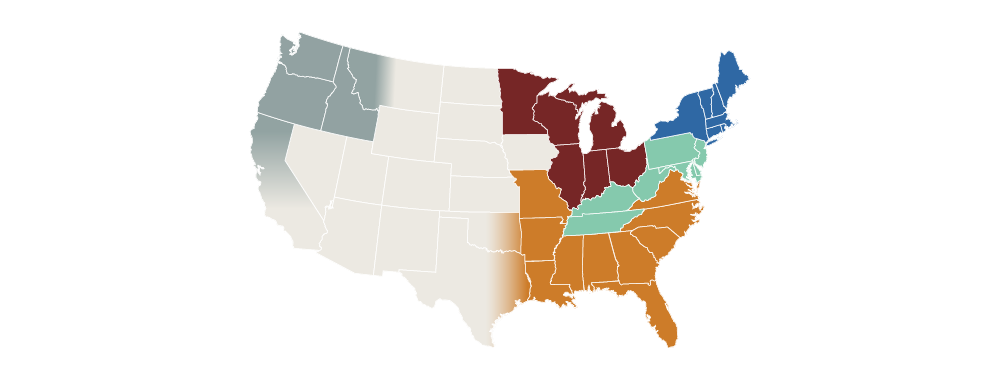

Timberland Investment Target Areas:

West

Softwoods

(Douglas fir)

Products:

Log Exports to Asia

Framing Lumber

Plywood

Pulp

Lake States

Hardwoods and Softwoods

Products:

Furniture

Fine Paper

Appalachia

Hardwoods

Products:

Furniture

Flooring

Export

Northeast

Hardwoods

Products:

Furniture

Flooring

Export

Southeast

Softwoods

(such as Loblolly)

and Hardwoods

Products:

Framing Lumber

Building Panels

Pulp

Wood Pellets