Over the past month, duties on Canadian softwood lumber imports into the United States have increased significantly. This shift raises the cost for Canadian producers to ship lumber into the U.S. and sets a higher domestic price floor, potentially improving competitiveness for U.S. mills. Below, we outline the benefits and implications.

Revised Duty Structure

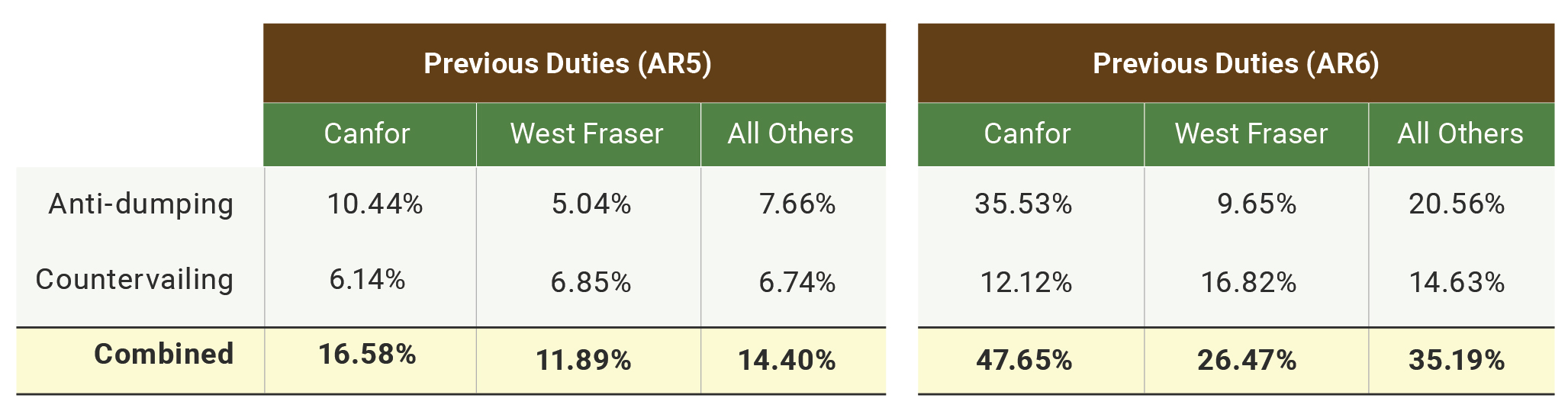

Canadian softwood lumber imports are subject to two key duties: a countervailing duty, which addresses alleged government subsidies, and an anti-dumping duty, which addresses product sales below fair market value. As part of its Sixth Administrative Review (AR6) of the U.S.-Canada lumber trade dispute, the U.S. Department of Commerce announced the following updates:

• Anti-dumping duty (effective July 29, 2025): Increased from 7.66% to 20.56% for most Canadian producers.

• Countervailing duty (effective August 12, 2025): Increased from 6.74% to 14.63% for most Canadian producers.

With both duties combined, the total burden for most Canadian softwood lumber imports rises from 14.40% under AR5 to 35.19% under AR6. Some Canadian producers, including Canfor and West Fraser, received individualized rates, as summarized below:

These duties will remain in effect until the Seventh Administrative Review (AR7), expected in mid-2026, or until a negotiated settlement is reached between United States and Canada.

Section 232 Investigation Adds Uncertainty

In addition to the AR6 updates, a Section 232 national security investigation on Canadian lumber imports was launched by the Trump Administration on March 1, 2025. The U.S. Department of Commerce is required to submit its findings within 270 days of the Administration’s request. Potential outcomes could include new tariffs layered on top of existing duties, the imposition of import quotas, or no further action.

Implications for U.S. Lumber Markets

In 2024, Canada shipped 12 billion board feet (BBF) of softwood lumber to the U.S., accounting for 24% of the 51 BBF consumed domestically. The recent duty increases are likely to reduce import volumes from Canada and shift market dynamics in favor of domestic production.

Lumber producers in the U.S. Pacific Northwest stand to benefit, as their species and grades are direct substitutes for Canadian softwood. Southern producers may also gain, given partial overlap between Canadian spruce-pine-fir (SPF) and southern yellow pine (SYP) from the U.S. South.

Timberland investors with holdings in the Pacific Northwest and the South may see improved markets for harvested sawlogs. In contrast, forestland in the Northeast and Lake States is unlikely to experience material benefit, as these regions account for less than 5% of the U.S. softwood lumber production.