An investor with timberland investments, or with plans to make timberland investments, may be wondering how the incoming Trump presidency will impact the asset class. The potential effects are numerous. There are many policy actions that in one shape or another are likely to affect economic activity in the country and the economy in general. These include deregulation, easing of environmental rules, rollback of climate action, and the renewal of expiring tax cuts. However, we believe that timberland investors should focus their attention on two specific policy areas: (a) tariffs, and (b) illegal immigration. Of the two, enactment of tariffs could be modestly beneficial to timberland investments in the U.S., while a crackdown on illegal immigration could be harmful.

Tariff Effects on Timberland

President-elect Donald Trump proposed during his campaign that the U.S. impose tariffs of 10% to 20% on all imports. Following the election, Trump then announced that he may place 25% tariffs on goods from Canada and Mexico, with an additional 10% levy to China if these countries fail to stop illegal immigration and illicit drug shipments to the U.S.

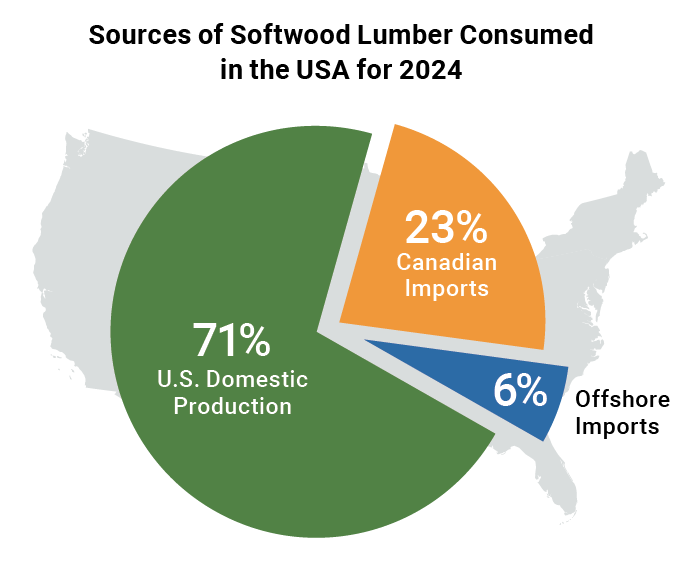

It is important to note that there is speculation that that president-elect is using potential tariff enactment primarily as a negotiating tool to extract better terms from trading partners. But should these tariffs come into play domestic timber demand would be driven higher as the U.S. is not self-sufficient in its wood needs. In fact, the U.S., overall, imports more wood (and wood products) than it exports. Take, for example, softwood lumber, which is the leading commercial product made from timber. The U.S. consumed 50 billion board feet of softwood lumber in 2024; 23% came from Canadian imports (see chart). Another 6% came from offshore – primarily from European Union countries like Germany and Sweden. Only 71% of the U.S. softwood lumber needs were met by domestic mills.

Likewise, imports are needed to fill the demand gap for wood panels. Close to 15% of the U.S. plywood market for 2024 is captured by imports. In addition, 3% to 5% of the oriented standboard (OSB), particleboard, and medium density fiberboard (MDF) market is made up of imports.

The third major industrial wood product that could be subject to tariffs is pulp & paper. U.S. mills make pulp, graphic paper, packaging paper, containerboard, and tissue that competes globally against foreign producers from all parts the world, including Europe, Asia, and Latin America.

Whether it is lumber, panels, or pulp & paper, U.S. tariffs on trade partners could give domestic producers a competitive advantage over imports.

Whether it is lumber, panels, or pulp & paper, U.S. tariffs on trade partners could give domestic producers a competitive advantage over imports. That would benefit investors in U.S. timberland through stronger demand (and pricing) for timber grown and harvested from domestic forest assets.

In terms of the major timberland investment regions, the largest beneficiary would be the U.S. Pacific Northwest, as lumber produced from timber in that region is a direct substitute or close substitute to the spruce-pine-fir (SPF) lumber imported from Canada and the spruce lumber imported from Europe. The second beneficiary would be the U.S. South, which produces a different type of softwood lumber than that imported from Canada and Europe but can serve as an indirect substitute.

Internationally, U.S. tariffs will have little or no impact on timberland investments in Australia or New Zealand, as their export market is focused on Asia and not North America. On the other hand, Latin America’s forest plantations could be harmed because they rely on the U.S. to export pulp and panels. Finally, there is likely to be a negligible impact on European timberland. Supplies of timber in the European Union (EU) are on the decline due a bark beetle epidemic, which will keep EU log prices high despite fewer lumber shipments to the U.S.

Impact of Immigration Enforcement on Timberland

A second Trump Presidency’s other major policy action that could have a significant impact on timberland investments is immigration enforcement. Any sweeping deportation of undocumented immigrants could hurt residential construction. This would in turn hurt wood demand because the building of new homes and the remodeling of existing homes combined consumes 70% of softwood lumber demand in the U.S.

Pew Research estimates that 13% of the construction industry is made up of undocumented workers.1 In some states like Texas and California, illegal immigrants make up as much as half of the home building workforce. Loss of that workforce will slow the pace of home construction across the U.S.

Despite the real threat, our judgment is that a full-scale round-up and deportation of undocumented residents is unlikely. Since the election, Trump has revealed that his priorities are to (a) seal the U.S. borders from further illegal crossings, and (b) focus enforcement and deportation on immigrants with criminal backgrounds. Note, that it is not just the construction sector that relies heavily on undocumented immigrants. Agriculture, meat packing, hospitality, and food service are also highly reliant on this labor source. The political pushback by these industries would be strong. Thus, there is a good likelihood that the Trump Administration will deem the cost of political capital for mass deportation to be too high.

Conclusion

There are many potential pathways in which the incoming Trump Administration could impact an investor’s U.S.-based timberland portfolio. The two most pertinent are (a) the enactment of new tariffs and (b) aggressive immigration enforcement. Between the two, we believe that the former is more likely. A 10%, 20% or greater tariff regime that includes wood-product imports would give domestic producers of lumber, panels, and pulp an opportunity to gain market share. That, in turn, would be mildly beneficial for timberland owners through stronger demand for timber.

While we consider the odds to be less, we cannot discount the real risk of immigration enforcement that results in a large loss of construction labor in the housing sector. That could negate any benefit tariffs would bring to timberland owners. Again, President-elect Trump is likely to enact other policy initiatives related to taxes, regulatory reform, and the environment that will affect timberland assets. Consequently, we will continue to monitor and follow policy and legislative changes that may impact timberland investors.

1 Elizabeth Findell and Gina Heeb. Wall Street Journal, “Construction Industry Braces for One-Two Punch: Tariffs and Deportations.” (December. 3, 2024)