Since we wrote What to Know About New Canadian Tariffs: A Brief for U.S. Timberland Investors on March 5, 2025, developments in tariff and trade policy from the Trump Administration have come in at a furious pace. Given the lack of certainty and clarity, it is hard to make heads or tails of the situation and consequently we recommend investors take a cautious approach to adjusting their asset allocation. To assist timberland investors with U.S. forest holdings, we provide a fresh assessment of the current trade environment and how it could impact wood product markets.

Summary of Developments in U.S. Trade Policy Regarding Forest Products

The Trump Administration announced on April 9, 2025, a 90-day pause on the increase in reciprocal tariffs. However, baseline tariffs of 10% remain for all countries except China, whose rate has been raised to an onerous 145%. China, in return, placed 125% tariffs on U.S. goods.

The U.S. wood products sector thus far has been largely spared of the trade war’s immediate impact. Imports from Canada and Mexico that are USMCA-compliant will remain tariff-free. The USMCA, otherwise known as the United States-Mexico-Canada Agreement, is a trade treaty that replaced the previous North American Free Trade Agreement (NAFTA) in 2020. Canadian wood imports such as lumber and oriented strandboard (OSB) count as USMCA compliant.

U.S. Duties on Canadian Softwood Lumber Imports

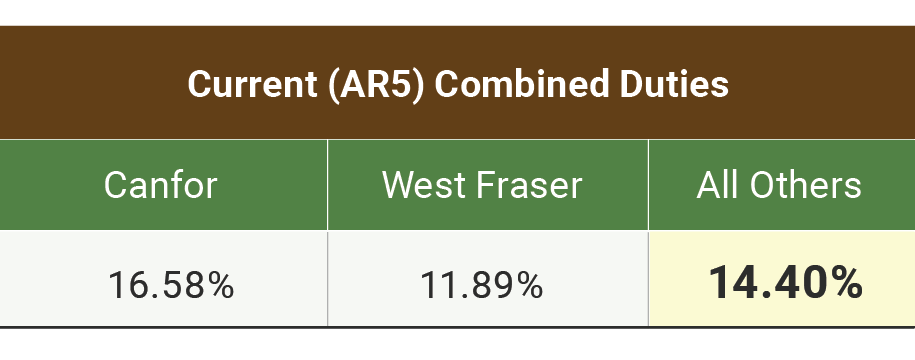

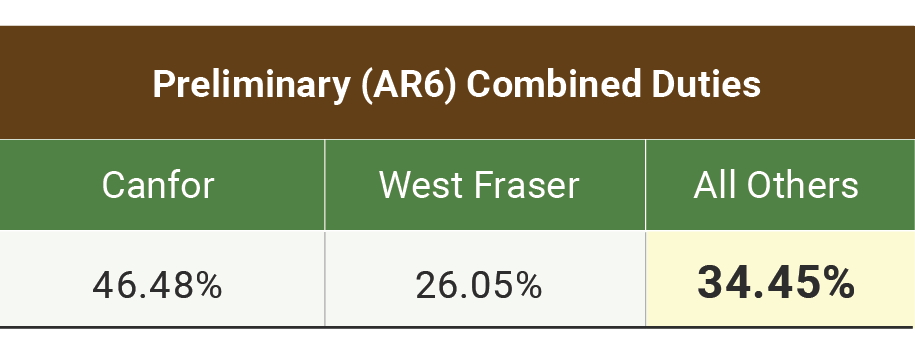

Canadian softwood lumber shipments, however, still face U.S. anti-dumping and countervailing duties that total 14.4% for most mills, with specific rates for Canfor and West Fraser (see chart below). These duties are set annually by the U.S. Department of Commerce and predate the current Trump Administration. Across March and April, the Commerce Department revised the anti-dumping and countervailing rates in their Sixth Administrative Review1 (AR6) at a combined rate of 34.45% for most Canadian lumber producers. The rates are preliminary, but if they go into effect in late summer or early fall (Q3/Q4) as expected, it will effectively double the duties on Canadian softwood lumber imports. This will severely impact the competitiveness of Canadian lumber producers in the U.S market.

The added complication is that the White House on March 1, 2025, ordered a Section 232 national security investigation on Canadian lumber imports. A Section 232 investigation as prescribed under the Trade Expansion Act could lead to quotas or additional tariffs on top of the existing duties that Canadian lumber producers face. The U.S. Commerce Department has 270 days to complete the Section 232 investigation.

Impact on the Wood Products Sector

Last year, 2024, Canada supplied 23% of the 50 billion board feet (BBF) of softwood lumber consumed in the United States as tracked by Forest Economic Advisors (FEA).2 A ramp up of duties on Canadian lumber imports from 14.4% to 34.45% in the second half of the year will likely harm the profitability of many Canadian mills. Furthermore, a Section 232 investigation which may result in additional punitive duties on Canadian lumber imports. Regardless of the Section 232 findings, the raised duties to 34.45% would hasten the closure of mill capacity across Canada, particularly the smaller, higher-cost mills. In response, U.S. lumber producers in the Pacific Northwest and the U.S. South will likely take advantage of the contraction in Canadian imports to capture market share and ramp up production.

In terms of hardwoods, the U.S. is a net exporter of hardwood lumber, primarily from the U.S. Northeast and the U.S. Lake States. Last year, the U.S. exported 1.2 BBF of hardwood lumber, or 25% of 4.9 BBF produced. Of these exports, the Chinese market for U.S. lumber is the one that is at stake. China took 0.42 BBF or one-third of the exports in 2024. That means 8.5% of American hardwood production went to the Chinese market. Should China’s 125% tariffs imposed on U.S. goods shutdown this export channel, hardwood exports will likely be redirected to Canada, Vietnam and Mexico – all three countries combined purchased more U.S. hardwood lumber than China in 2024.

It should be noted that duties or tariffs on lumber and wood panels have little effect on housing affordability. An independent analysis performed with home builder cost data provided by the National Association of Home Builders (NAHB) indicated that a 25% increase in lumber and panel prices generated from additional duties or tariffs could increase the monthly mortgage payment on a median-priced single-family home by just $15-$30.3

Impact on the Pulp and Paper Sector

In the past, the U.S. shipped softwood pulp – about one million tonnes or 3% of total annual U.S. pulp production – to China. In return, U.S. imports tissue, paper and packaging from China. This trade will likely collapse with the present state of tariffs and counter-tariffs between the two countries.

This should not have a meaningful short-term impact on pulp and paper as they are globally traded commodities. U.S. pulp shipments can be redirected away from China and towards Europe, Middle East, and Africa. The U.S. is the dominant supplier of a special type of softwood pulp called fluff pulp. Finding new global buyers for this type of pulp is not expected to be a challenge.

Impact to Timber Markets and Timberland Assets

As presently envisioned, we do not see immediate negative effects of the Trump Administration tariff and trade policies on timber market nor the value of timberland assets. The U.S. is a net importer of wood products. As such, the increase in duties on Canadian lumber imports later this year can support a mild uplift of sawlog prices in the U.S.

Most concerning is that the unpredictable nature of the Administration’s tariff and trade actions is eroding consumer and business confidence. The U.S. dollar has weakened, and the yields of U.S. Treasury bonds have risen. All these factors can be expected to push off critical decisions related to new construction and investment, thus significantly slowing economic growth. Fewer homes built and less spending on home improvement will eventually hurt timber prices. The key factor is how long the trade war lasts. A quick resolution would prevent the Trump tariff actions’ most harmful economic effects from occurring.

Despite a weakening macroeconomic outlook, timberland values should hold up better than most other asset classes. Timberland – as a real asset – historically performs well amid economic uncertainty and rising inflation. Particularly given all the uncertainty over tariff implementation, we recommend timberland investors not adjust their long-term strategy for the asset class at this point. Timberland’s capital preservation and inflation-hedging characteristics have an important role to play amid the trade policy ambiguity we are experiencing today.

1 The Administrative Review is an annual assessment conducted by the U.S. Commerce Department to determine the rates for countervailing duties and anti-dumping duties placed on Canadian softwood lumber imports.

2 Forest Economic Advisors, Timber Quarterly Forecast Q1 2025. (March 13, 2025)

3 Forest Economic Advisors, “Tariffs Would Be a Drop in the Housing Affordability Bucket.” (March 20, 2025)