Following a period of robust performance in 2021 and 2022, the U.S. housing sector has since moved at a slower pace. Over the last three years, key indicators, such as sales of existing homes, new residential construction, and home improvement spending, have remained weak. For timberland investors, this matters, as timber markets are structurally tied to the housing sector. More than 70% of U.S. lumber demand is driven by new home building or home improvement.

Introduction

This paper evaluates whether this extended period of weakness reflects a new normal, or simply a cyclical low ahead of recovery. Understanding that distinction is important for assessing the outlook of timber prices, lumber demand, and long-term timberland asset performance.

Why Housing Has Been Weak: Affordability and Uncertainty

The current market softness stems from two primary, quantifiable factors: a marked decline in affordability and consumer confidence.

Affordability Challenges

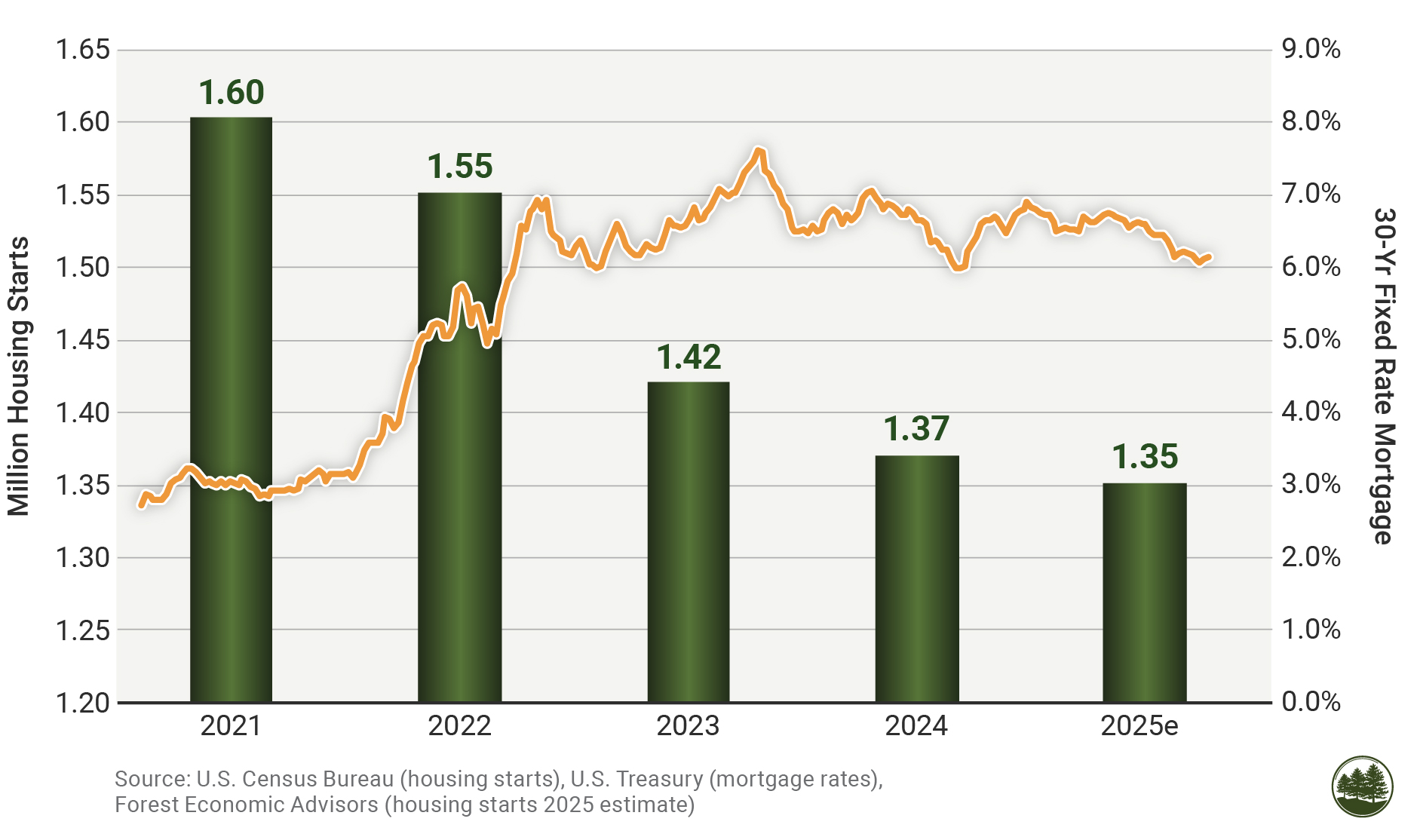

The primary factor behind the housing market weakness is affordability. Mortgage rates rose sharply from 2021 through 2023, reaching a high of 7.8%, rates not seen since the 2008 global financial crisis, before easing back towards 6.0% in November 2025 (Figure 1). For reference, a doubling of rates pushes monthly payments more than 40 percent higher, putting many buyers on the sidelines.

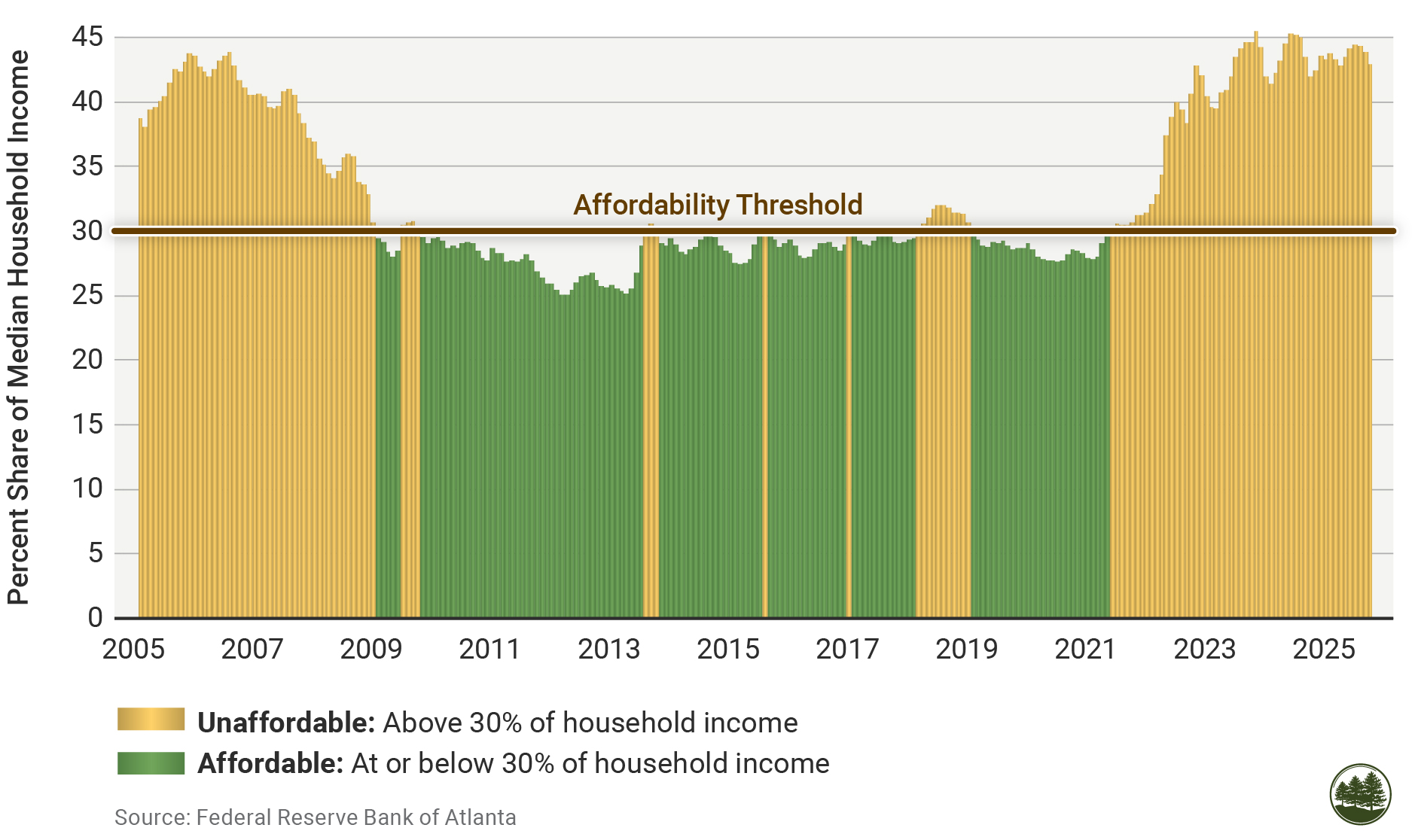

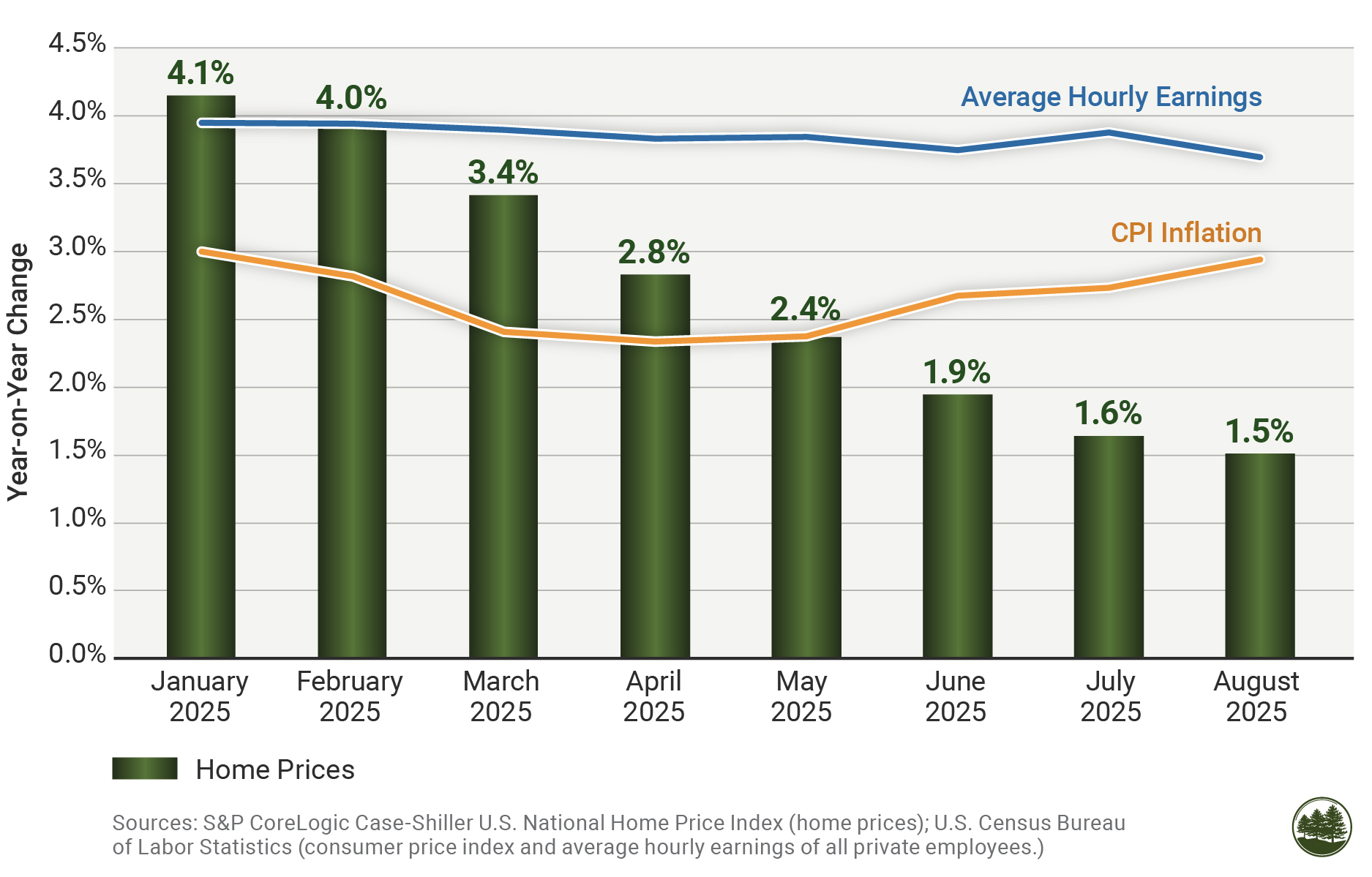

At the same time, home prices have grown faster than wages. Over the past five years, prices increased at roughly 8% per year, as shown by the Case-Shiller Home Price Index, while private wages grew1 at less than half that pace. By late 2025, a household earning a median income of $85K would need to spend about 43% of its earnings to buy a single-family house, significantly exceeding typical affordability levels (Figure 2). A home is considered affordable when ownership costs are under 30% of household income. These dynamics have placed homeownership out of reach for many households.

As demand for new homes weakened, home builders responded by cutting back on new construction. By the end of 2025, annual housing starts will likely be around 1.35 million, short of last year’s 1.37 million and well below 1.60 million in 2021.

Figure 1. Annual Housing Starts (left) and 30-Year Fixed Rate Mortgage (right).

Higher mortgage rates also slow home repair and remodeling (R&R) spending, which is a major source of lumber and panel demand:

- Borrowing costs for home improvement projects increase as interest rates rise, reducing the number of projects financed.

- R&R also tends to move in step with existing home sales; many upgrades occur just before a home is listed for sale or shortly after it is purchased. When existing home sales decline, R&R spending softens as well.

Figure 2. Share of Median Income Needed to Afford a Median-Priced Single-Family Home in the United States.

Softening Household Confidence

Affordability is not the only issue affecting the housing sector. Households have also faced mixed economic signals. Slower job growth, periodic layoffs, and shifting tariffs have impacted consumer confidence. The University of Michigan Consumer Sentiment Index decreased to near a record low of 50.1 in November 2025, compared to 88.3 in April of 2021. When people are unsure about their financial outlook, they delay taking on a major, long-term commitment such as purchasing a home.

What Needs to Happen for Housing to Recover

To understand how the housing market can move past its recent slowdown, it is helpful to look at the conditions that would support a broader recovery.

Lower Mortgage Rates

Any sustained improvement starts with better affordability. Lower mortgage rates help more home buyers qualify for mortgages and reduce monthly payments, which leads to more home sales and encourages home builders to start new housing projects.

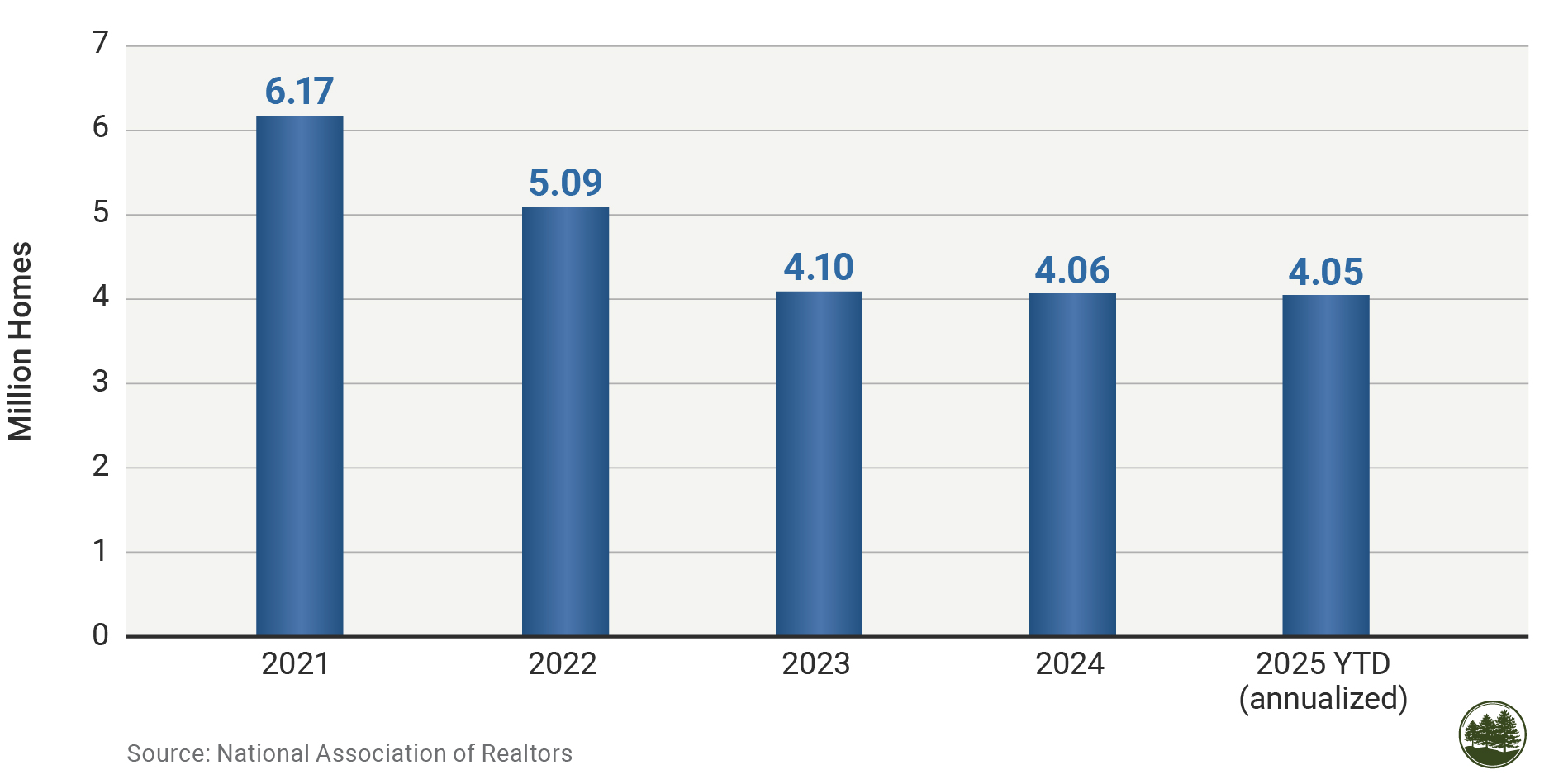

Lower rates also weaken the “lock-in” effect that keeps homeowners from selling, because moving would force them to replace their current low-rate mortgage with a much higher one, making the next home significantly more expensive to finance. This has led to home sales falling by one-third from 6.17 million back in 2021 to 4.05 million (annualized) through the first three quarters of 2025 (Figure 3). When more owners feel comfortable putting their homes on the market, overall activity increases and so does spending on home improvement, which increases demand for wood-based building products.

Figure 3. Total Existing Home Sales in the U.S., 2025 year-to-date is through September. Sales numbers are seasonally adjusted.

Restored Consumer Confidence

A healthy job market and an improving economy are critical to raising consumer sentiment. For confidence to return, consumers need evidence that the economy is stabilizing. Specifically:

- the U.S. economy avoids a downturn or recession in 2026

- businesses resume net new hiring

- inflation moves below 2.5%

Signs of Improvement Toward the End of 2025

Even with recent challenges, several developments point toward gradual progress:

- Declining mortgage rates

As inflation expectations ease, the 30-year fixed rate mortgage rate fell more than 60 basis points between January and November, 2025 (from 6.91% to 6.24%). - Home builders are building affordable homes

Builders have responded to the affordability crunch by shifting toward smaller, more attainable homes. The average size of a single-family home built in 2025 (2,393 sq. ft.2) is about 6 percent smaller than in 2021 (2,538 sq. ft.). In addition, construction costs have either stabilized or fallen, allowing builders to transfer a portion of these savings to buyers. As a result, the median price of a new home in August 2025 was 10 percent lower than its 2022 peak.3 - Home prices are falling in real terms

During the second half of 2025, year-on-year price increases for existing homes are now running below the pace of inflation and wage growth (see Figure 4). If this continues, homes will steadily become more affordable.

Figure 4. Annual Rates of Home Prices, CPI Inflation and Hourly Earnings.

What This Means for Lumber Demand

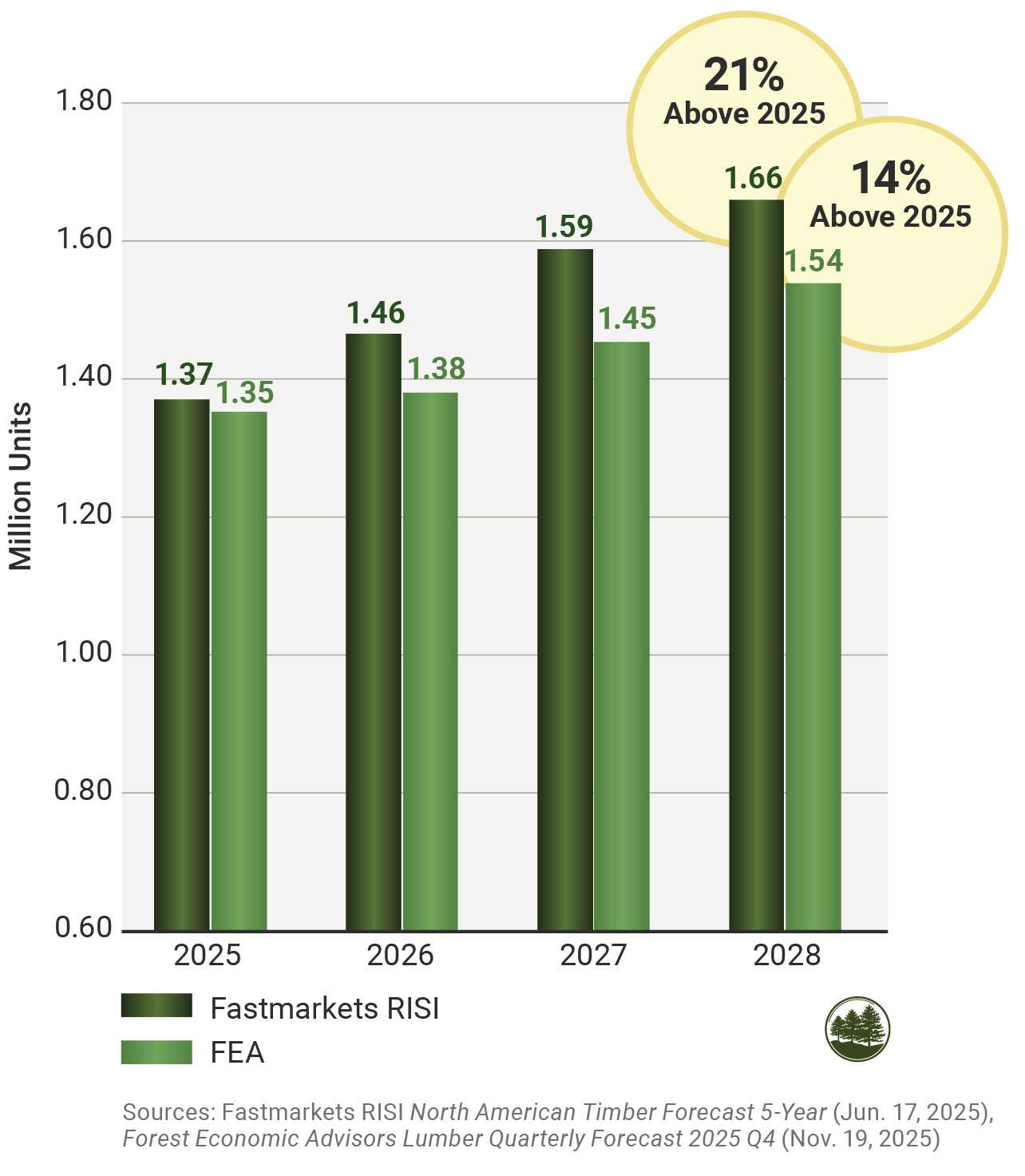

As the housing market improves, both new construction and R&R activity tend to rise. Forecasts from two leading industry groups, Fastmarkets RISI and Forest Economic Advisors, show U.S. housing starts rising by 14 to 21% between 2025 and 2028 (Figure 5). R&R is forecasted to follow a similar trajectory.

More homebuilding lifts demand for framing lumber, panels, and engineered wood used throughout residential construction. At the same time, stronger home sales usually lead to more remodeling projects, as many homeowners update a property before listing it or after moving in. Together, these trends support a broad increase in wood-product demand.

Figure 5. Forecasts of U.S. Housing Starts By Fastmarkets RISI and FEA.

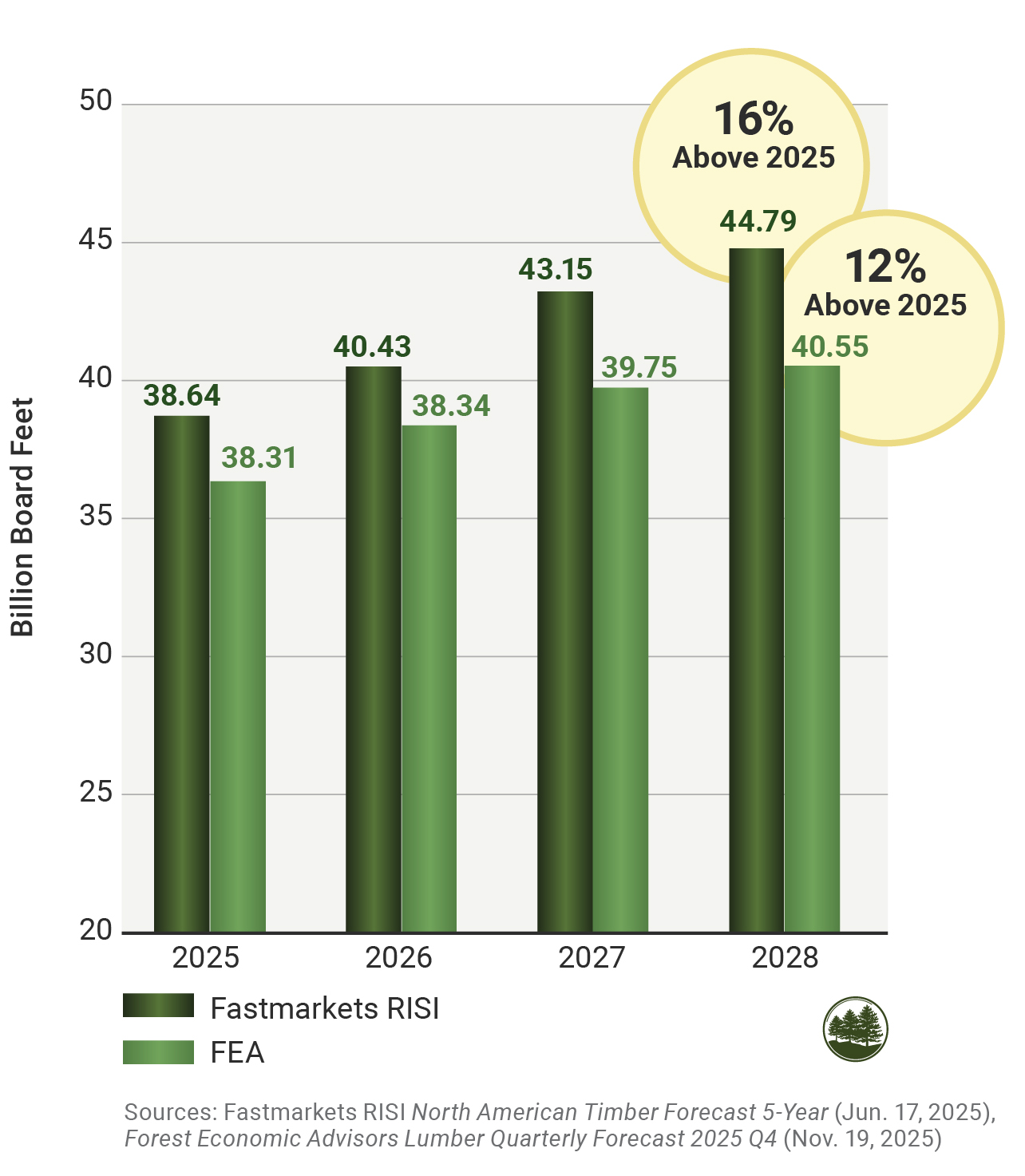

Figure 6. Forecasts of U.S. Lumber Production By Fastmarkets RISI and FEA.

Industry forecasts project U.S. lumber consumption to rise between 8 and 14% from 2025 to 2028. As demand increases, mills typically operate at higher utilization rates, which supports a more stable production environment and healthier pricing conditions.

At the same time, lumber imports from Canada and Europe are expected to decline due to ongoing supply constraints in both regions. Less import pressure means domestic mills can capture more market share, which would support stronger operating conditions for U.S. producers. U.S. lumber output could rise by 12% to 16% over the next three years according to FEA and RISI respectively (Figure 6).

Implications for Timberland Investors

The last three years have been difficult for the housing sector, yet the long-term demand drivers remain in place: population growth, an aging housing stock, and years of underbuilding. Freddie Mac estimated in late 2024 that the U.S. has roughly 3.8 million homes of pent-up demand.4 At the same time, the nation’s housing stock is aging, with the median owner-occupied home now about 44 years old,5 after more than a decade of under-building following the Global Financial Crisis. As mortgage rates ease and consumer confidence improves, conditions appear set for a gradual recovery.

For long-term investors, timberland remains a stable, durable asset. Its biological growth, low correlation to other markets, inflation protection, and diversified sources of revenue continue to support long-term value creation. Remaining invested through short-term fluctuations positions investors to benefit from the recovery that typically follows periods of housing market softness.

1 Source: Average hourly earnings from all private employers, as tracked by the U.S. Bureau of Labor Statistics.

2 Forest Economic Advisors Lumber Quarterly Forecast 2025 Q4 (Nov. 19, 2025)

3 Median sales price of new houses sold in the U.S. Source: U.S. Department of Housing and Urban Development

4 Freddie Mac, “Housing Supply: Still Undersupplied by Millions of Units.” (Nov. 26, 2024)

5 Source of median age of houses: U.S. Census Bureau American Housing Survey.